Despite weekly optimism, XRP has dropped below the $3 mark again, frustrating its community as the token falls behind broader market trends. Currently, it is trading near $2.90, down more than 4% in the past 24 hours, with a market cap of around $173 billion.

Despite a historic U.S. spot XRP ETF launch and Ripple’s strengthened ties with Spain’s BBVA bank, the token has failed to sustain upward momentum.

Analysts now argue that XRP’s sluggish performance can no longer be blamed on the U.S. Securities and Exchange Commission (SEC) lawsuit, which has long been cited as a key obstacle to growth. With that case resolved, attention has shifted to deeper market dynamics.

Profit-Taking, Liquidations, and Market Sentiment

XRP’s ETF debut generated record $37 million in day-one trading volume, but it also triggered a classic “sell the news” response. Many institutional investors exited positions, sparking heavy selling pressure.

Adding to the downturn, XRP traders faced nearly $79 million in liquidations over the past day, with long positions making up the majority. This wave of forced selling drove prices down, undermining confidence among retail investors.

Meanwhile, the broader crypto market lost 4% in value, with billions wiped from altcoin capitalization. Ethereum (ETH) and other major assets also saw steep declines, further dragging XRP down.

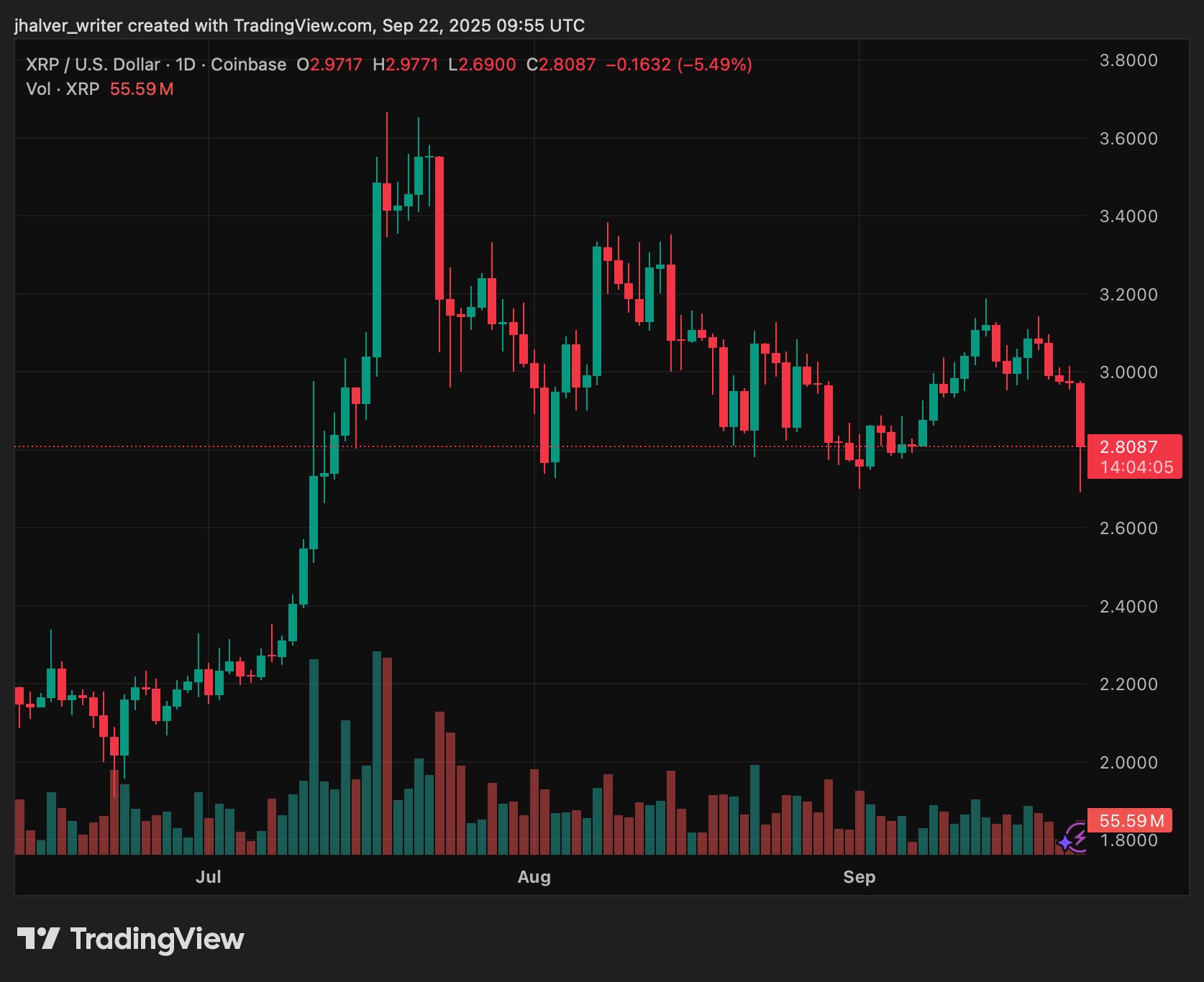

XRP's price records important losses on the daily chart. Source: XRPUSD on Tradingview

Can XRP Avoid a Steeper Decline?

XRP is now battling to hold support near $2.80, with traders warning that a break lower could expose the token to the $2.50–$2.60 zone. Bulls, on the other hand, need to reclaim the $3.10–$3.20 range to re-establish momentum and revive hopes of testing the $3.65 all-time high.

Market sentiment remains mixed. Some commentators, such as analyst BarriC, suggest XRP could still surge dramatically if it follows historical patterns, even hinting at a possible $300 price target by 2026.

Others remain skeptical, pointing to continued selling pressure and tighter regulatory compliance requirements for altcoin ETFs. For now, XRP holders face a crucial test: defend current levels or risk deeper losses as the altcoin market selloff accelerates.

Cover image from ChatGPT, XRPUSD chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.